Precision-Driven Title Services for the U.S. Mortgage Industry

Secure, compliant, and scalable offshore title solutions designed to improve turnaround time, accuracy, and operational efficiency for lenders, title agencies, and settlement service providers.

Client Benefits & Measurable Outcomes

Up to 50% cost savings compared to onshore operations

Turnaround time improvements of up to 40% for high-volume title orders

Enhanced accuracy through multi-level QC and compliance checks

Scalable operations to handle peak workloads without quality compromise

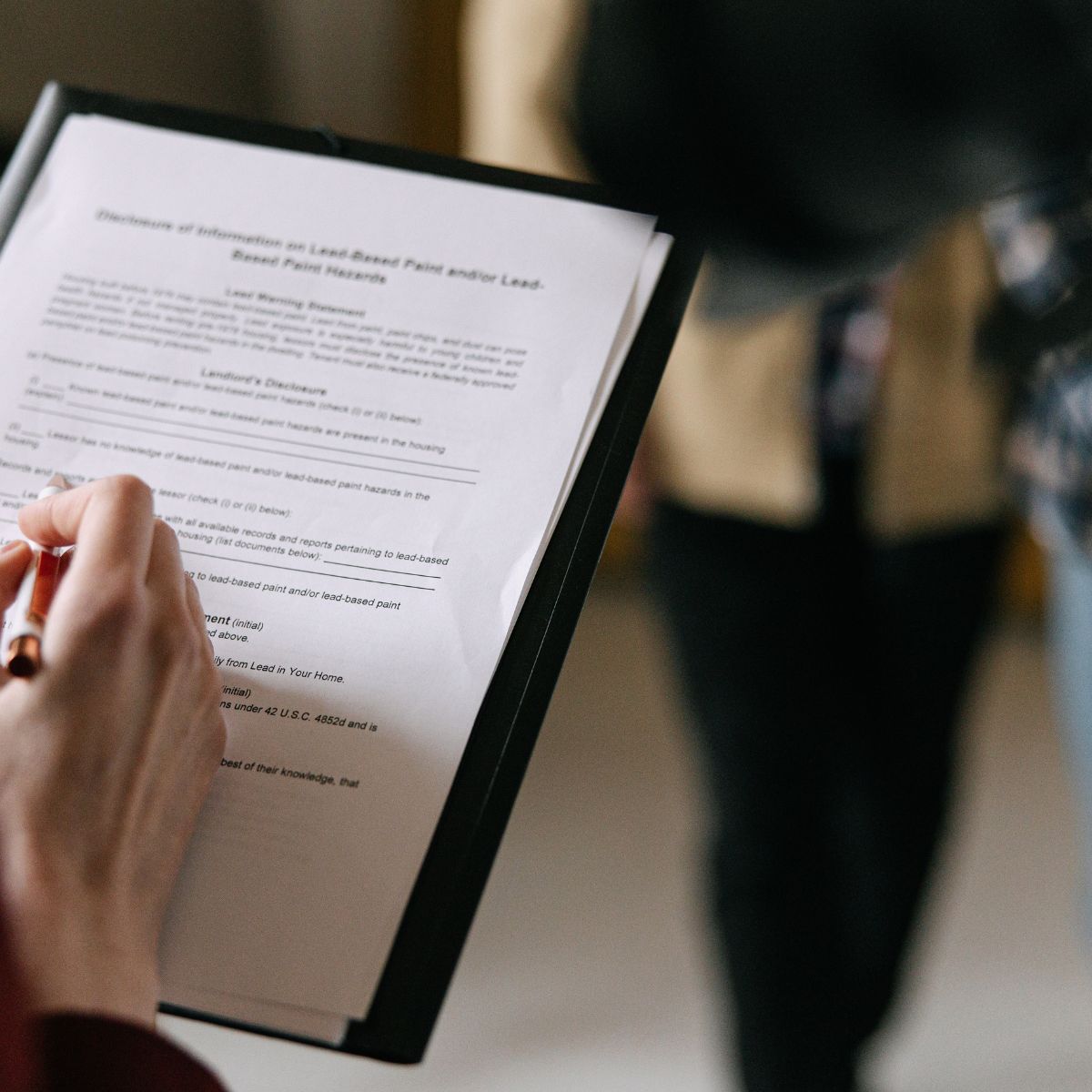

Meeting the Demands of Modern Title Operations

The U.S. mortgage industry demands precision, compliance, and speed in title services. Outsourcing title processes to specialized offshore teams offers significant advantages, including cost savings, faster turnaround times, and access to skilled professionals trained in U.S. regulations. Our solutions are designed to mitigate risks, ensure compliance, and deliver exceptional value to lenders, title agencies, and settlement service providers

Our Title Services

Title Search Services

We conduct exhaustive searches including Current Owner, Two-Owner, and Full Chain of Title. For example, a Full Chain search covers 30+ years of property history, ensuring no hidden liens or encumbrances.

Title Plant Indexing

Our team indexes deeds, mortgages, liens, and judgments into major U.S. title plants such as DataTrace®, TitlePoint®, and SoftPro®. This ensures accurate and quick retrieval of property records.

Title Insurance Support

From policy review to curative services, we support the identification and resolution of title defects, ensuring accurate documentation and timely issuance of title insurance policies.

Title Commitment & Policy Typing

We prepare preliminary reports and commitments, including CPL documentation, to streamline closing processes.

Closing & Post-Closing Support

We manage document preparation, payoff processing, and escrow coordination, ensuring smooth transactions.

Compliance & Quality Support

Our multi-level QC checks and strict adherence to U.S. compliance standards ensure consistent accuracy, regulatory alignment, and reliable title deliverables.

Technology & Platform Expertise

Our team is proficient in leading U.S. title production platforms such as DataTrace®, TitlePoint®, Tapestry®, AIM®, RamQuest®, and SoftPro®. We leverage automation tools and API integrations to enhance efficiency and reduce manual errors.

Compliance Standards & Data Security

We adhere to globally recognized compliance frameworks and are SOC 2 compliant. Our secure infrastructure ensures data confidentiality, integrity, and availability, with encrypted communication channels and restricted access protocols.

Why Choose Us?

Domain Expertise

Skilled analysts trained in U.S. title processes and regulations

Technology Integration

Seamless workflow with leading title production platforms

Scalable Operations

24×7 support with rapid turnaround for high-volume orders

Cost Advantage

Offshore delivery model ensuring significant savings without compromising quality

Ready to Transform Your Title Operations?

Partner with us to experience reliable, fast, and compliant title services tailored to the needs of the U.S. mortgage industry. Our team works as an extension of your operations to improve turnaround times, maintain compliance, and deliver consistent quality. Contact us today to discuss your requirements and explore how we can add measurable value to your business.